Utlizing ‘AI’ Artificial Intelligence Software in the Hospitality Industry

Have you ever wanted more time and more help in your...

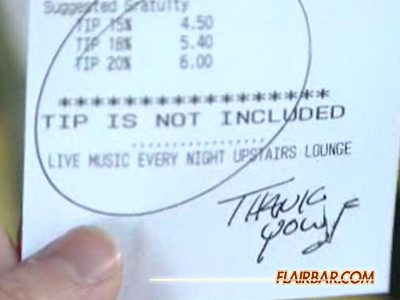

Wow! Speaking of changes. There is a lot of concern going around in the hospitality industry in the United States right now regarding tipping and auto gratuity added to checks. It seems that things still may be a bit unclear and we hope to help to shed some light on the subject.

Here is an article that appeared in the Wall Street Journal…

“An updated tax rule is causing restaurants to rethink the practice of adding automatic tips to the tabs of large parties.

“An updated tax rule is causing restaurants to rethink the practice of adding automatic tips to the tabs of large parties.

Still, the ruling has caused some confusion. Some restaurants insert an amount on the tip line and then remind guests on the check that they are free to adjust that amount up or down. Ms. Dyson, the payroll tax attorney, said that practice could come under scrutiny from the IRS. “How far can you go before the IRS says that looks like a service charge?” Ms. Dyson says.”

Here is what Scott Young from the Bartending Masters has to say about it…

Here is what Scott Young from the Bartending Masters has to say about it…

“Wow! I never imagined my last blog post regarding the IRS taxing auto gratuities would get so much attention. The discussions in the comments were colorful to say the least and a lot of arguments were made. It is quite clear that there are some problems in the industry regarding how hospitality staff are compensated.

Before we get into it, I want to make an apology. I must admit my original blog post title wasn’t clear and may have led some to believe that establishments can no longer charge auto gratuities. The truth is that they still can as long as they withhold these from the staff and tax them like regular wages. However, due to the ruling many restaurants (like the Olive Garden for instance) have done away with auto gratuities. It’s confusing so you can read more about this IRS ruling here: Rev. Ruling 2012-18

Now, here are some common thoughts regarding the industry and the history and role of tipping…

Many individuals argued due to the low minimum wage many states can legally pay servers (as low as $2) that they need the tips to survive. I agree that many of you count on those tips and if you don’t receive them, you go without.

However, the nature of a tip and its history has always been about an optional variable amount based on the service given. The history of tipping should not be ignored here.

As some have stated, the responsibility lies on the employer to compensate their staff fairly and it is unfair to take this frustration out on the customer. Fair point.

What is frustrating when it comes to customers? When you give great service and get little to no tip… This can really affect you and may be the reason some people have placed the blame on the customer. Many customers don’t think a tip is deserved, no matter how good the service is.

Someone posted, “A tip is not mandatory, however if decent or better service is given, I should receive a proper tip. It is defeating when I put a lot of effort in and that exceptional service is not appreciated.”

That is a fair and reasonable statement. That is a statement I think it would be hard for others to argue.

So in the end, do I think a tip should be mandatory?

No I do not, but if fair or better service is given then yes, some level of compensation definitely should be strongly considered and hopefully, the customer will recognize the extra effort and/or excellence of the server and reward them for it.

Want to increase your odds of getting tipped? Find ways to become an exceptional server.

To Tip or Not To Tip? This choice should be totally left up to the individual customer.

Don’t agree with me? Let’s hear your thoughts… What do you think a tip for “fair” service should be?

Thanks for reading!”

And this is what is in black & white from the IRS…

Internal Revenue Bulletin: 2012-26 |

June 25, 2012 |

Tips included for both employee and employer taxes. This ruling provides guidance for employers and employees in a question and answer format regarding taxes imposed on tips under the Federal Insurance Contributions Act (FICA), including information on the difference between tips and service charges, the reporting of the employer share of FICA under section 3121(q) of the Code, and the section 45B credit. See related Announcement 2012-25, published elsewhere in this Bulletin. Rev. Rul. 95-7 modified and superseded.

The purpose of this revenue ruling is to clarify and update guidelines first presented in Rev. Rul. 95-7, 1995-1 C.B. 185, concerning the taxes imposed on tips under the Federal Insurance Contributions Act (FICA) and the notice and demand under section 3121(q) of the Internal Revenue Code (Code).

Sections 3101 and 3111 of the Code impose FICA taxes on employees and employers, respectively, equal to a percentage of the wages received by an individual with respect to employment. FICA taxes consist of two separate taxes, the Old Age, Survivors, and Disability Insurance (social security) tax and the Hospital Insurance (Medicare) tax. The amount of wages subject to social security tax is limited by an annual contribution and benefit base; however, all wages are subject to Medicare tax.

Section 3121(a) of the Code defines “wages” for FICA tax purposes as all remuneration for employment, with certain exceptions. Section 3121(a)(12)(A) excludes from the definition of wages tips paid in any medium other than cash; section 3121(a)(12)(B) excludes cash tips received by an employee in any calendar month in the course of the employee’s employment by an employer unless the amount of the cash tips is $20 or more.

Employer FICA Obligations. Under section 3121(q) of the Code, tips received by an employee in the course of the employee’s employment are considered remuneration for that employment and are deemed to have been paid by the employer for purposes of the employer share of FICA taxes imposed by sections 3111(a) and (b), that is, social security tax and Medicare tax, respectively. The remuneration is deemed to be paid when a written statement including the tips is furnished to the employer by the employee pursuant to section 6053(a), discussed below.

Section 3111 of the Code requires the employer to pay social security tax on the amount of cash tips received by the employee up to and including the contribution and benefit base as determined under section 3121(a)(1) and to pay Medicare tax on the total amount of cash tips received by the employee. However, if the employee either did not furnish the statement pursuant to section 6053(a) or if the statement furnished was inaccurate or incomplete, in determining the employer’s liability in connection with the taxes imposed by section 3111 with respect to the tips, section 3121(q) provides that the remuneration is deemed, for purposes of subtitle F (Procedure and Administration), to be paid on the date on which notice and demand for the taxes is made to the employer by the Internal Revenue Service (Service).

Employee FICA Obligations. Under section 3121(q) of the Code, for purposes of the employee share of FICA taxes imposed by sections 3101(a) and (b), tips that are properly reported to the employer pursuant to section 6053(a) are deemed to be paid at the time a written statement is furnished to the employer pursuant to section 6053(a). Unreported tips received by the employee are deemed to be paid to the employee when actually received by the employee.

Section 6053(a) of the Code requires every employee who, in the course of the employee’s employment by an employer, receives in any calendar month tips that are wages (as defined in section 3121(a) for FICA tax purposes or section 3401(a) for income tax withholding purposes) to report all those tips in one or more written statements furnished to the employer on or before the 10th day of the following month. The employee is to furnish the statements in the form and manner prescribed by the Service. See § 31.6053-1(b) of the Employment Tax Regulations.

Credit for Employer Share of FICA Taxes Paid. Section 45B(a) of the Code provides that, for purposes of the general business credit under section 38, the credit for employer social security and Medicare taxes paid on certain employee tips is an amount equal to the “excess employer social security tax” paid or incurred by the employer. The term “excess employer social security tax” means any tax paid by an employer under section 3111 (both social security tax and Medicare tax) on its employees’ tip income without regard to whether the employees reported the tips to the employer pursuant to section 6053(a). Consequently, the section 45B credit is available with respect to unreported tips in an amount equal to the “excess employer social security tax” paid or incurred by the employer. No credit, however, is allowed to the extent tips are used to meet the federal minimum wage rate. For purposes of this limitation, the federal minimum wage rate is the rate that was in effect on January 1, 2007. The credit is available with respect to FICA taxes paid on tips received from customers in connection with the providing, delivering, or serving of food or beverages for consumption, if it is customary for customers to tip the employees.

Q1. Is the characterization of a payment as a “tip” by the employer determinative for FICA tax purposes under section 3121 of the Code?

A1. No. The employer’s characterization of a payment as a “tip” is not determinative. For example, an employer may characterize a payment as a tip, when in fact the payment is a service charge. The criteria of Rev. Rul. 59-252, 1959-2 C.B. 215, should be applied to determine whether a payment made in the course of employment is a tip or non-tip wages under section 3121 of the Code. The revenue ruling provides that the absence of any of the following factors creates a doubt as to whether a payment is a tip and indicates that the payment may be a service charge: (1) the payment must be made free from compulsion; (2) the customer must have the unrestricted right to determine the amount; (3) the payment should not be the subject of negotiation or dictated by employer policy; and (4) generally, the customer has the right to determine who receives the payment. All of the surrounding facts and circumstances must be considered. For example, Rev. Rul. 59-252 holds that the payment of a fixed charge imposed by a banquet hall that is distributed to the employees who render services (e.g., waiter, busser, and bartender) is a service charge and not a tip. Thus, to the extent any portion of a service charge paid by a customer is distributed to an employee it is wages for FICA tax purposes.

The application of the factors is illustrated by the following two common examples:

Example A: Restaurant W’s menu specifies that an 18% charge will be added to all bills for parties of 6 or more customers. Customer D’s bill for food and beverages for her party of 8 includes an amount on the “tip line” equal to 18% of the price for food and beverages and the total includes this amount. Restaurant W distributes this amount to the waitresses and bussers. Under these circumstances, Customer D did not have the unrestricted right to determine the amount of the payment because it was dictated by employer policy. Customer D did not make the payment free from compulsion. The 18% charge is not a tip within the meaning of section 3121 of the Code. The amount included on the tip line is a service charge dictated by Restaurant W.

Example B: Restaurant X includes sample calculations of tip amounts beneath the signature line on its charge receipts for food and beverages provided to customers. The actual tip line is left blank. Customer G’s charge receipt shows sample tip calculations of 15%, 18% and 20% of the price of food and beverages. Customer G inserts the amount calculated at 15% on the tip line and adds this amount to the price of food and beverages to compute the total. Under these circumstances, Customer G was free to enter any amount on the tip line or leave it blank; thus, Customer G entered the 15% amount free from compulsion. Customer G and Restaurant X did not negotiate the amount nor did Restaurant X dictate the amount. Customer G generally determined who would get the amount. The amount Customer G entered on the tip line is a tip within the meaning of section 3121 of the Code.

Q2. What tips must be reported to the employer?

A2. All cash tips received by an employee are wages for FICA tax purposes and, therefore, must be reported to the employer unless the cash tips received by the employee during a single calendar month while working for the employer total less than $20. If an employee works for more than one employer during a month and receives less than $20 in tips while working for each employer, no tips are required to be reported to any of the employers. Cash tips include tips received from customers, charged tips (e.g., credit and debit card charges) distributed to the employee by his or her employer, and tips received from other employees under any tip-sharing arrangement. Thus, both directly and indirectly tipped employees must report tips received to their employer. Non-cash tips (i.e., tips received by an employee in any other medium than cash, such as passes, tickets, or other goods or commodities) from customers are not wages for FICA tax purposes and are not reported to the employer. All cash tips and non-cash tips are includable in an employee’s gross income and subject to federal income taxes.

Q3. How are tips reported by the employee to the employer?

A3. The employee must give the employer a written statement (or statements) of cash tips by the 10th day of the month after the month in which the tips are received. Form 4070, Employee’s Report of Tips to Employer, is available for this purpose and may be found in Publication 1244, Employee’s Daily Record of Tips and Report to Employer. The statement may be furnished on paper or transmitted electronically. See § 31.6053-1(b) of the regulations.

Q4. How are FICA taxes paid on tips which are reported to the employer by the employee?

A4. The employer withholds the employee share of FICA taxes on the reported tips from the wages of the employee (other than tips) or from other funds made available by the employee for this purpose. See section 3102(c) of the Code and §§ 31.3102-3 and 31.3402(k)-1(c) of the regulations. The employer pays both employer and employee shares of FICA taxes in the same manner as the taxes on the employee’s non-tip wages and includes the reported tips on the employee’s Form W-2, Wage and Tax Statement. The employer makes a current period adjustment on Form 941, Employer’s QUARTERLY Federal Tax Return, to reflect any uncollected employee FICA taxes on reported tips. The employer reports any uncollected employee FICA taxes on the employee’s Form W-2, Wage and Tax Statement. The employee must report these amounts as additional tax on the employee’s Form 1040, U.S. Individual Income Tax Return (or other applicable return in the Form 1040 series).

Q5. If an employee fails to report tips to his or her employer, is the employee liable for the employee share of FICA taxes on those unreported tips?

A5. Yes. The employee is liable for the employee share of FICA taxes on the unreported tips. The employee pays his or her share of FICA taxes by completing Form 4137, Social Security and Medicare Tax on Unreported Tip Income, and filing it with Form 1040 (or other applicable return in the Form 1040 series) for the year in which the tips are actually received by the employee.

Q6. Which year’s social security and Medicare rates and social security contribution and benefit base apply to compute the employee’s FICA tax liability on unreported tips?

A6. The social security and Medicare rates and the social security contribution and benefit base applicable to the calendar year in which the tips were actually received apply to compute the employee’s FICA tax liability. Form 4137 includes the applicable social security and Medicare rates and social security contribution and benefit base. The employer is not liable to withhold and pay the employee share of FICA taxes on the unreported tips.

Q7. Are employees who fail to report tips to their employers subject to a penalty?

A7. Yes. Under section 6652(b) of the Code, an employee who fails to report tips required to be reported to an employer is subject to a penalty equal to 50 percent of the employee share of FICA taxes on those tips, unless the employee can provide a satisfactory explanation showing that the failure was due to reasonable cause and not due to willful neglect. The explanation must be made in the form of a written statement setting forth all the facts alleged as a reasonable cause. This statement can be attached to the employee’s Form 1040 (See Form 4137). If the statement is submitted in response to a notice regarding a proposed penalty assessment, the statement must contain a declaration that it is made under the penalties of perjury.

Q8. If an employee fails to report tips to his or her employer, is the employer liable for the employee and employer shares of FICA taxes on those unreported tips?

A8. If an employee fails to report tips to his or her employer, the employer is not liable for the employer share of FICA taxes on the unreported tips until notice and demand for the taxes is made to the employer by the Service. The employer is not liable to withhold and pay the employee share of FICA taxes on the unreported tips.

Q9. How is notice and demand made under section 3121(q) of the Code?

A9. There is no specific form or procedure prescribed for a Section 3121(q) Notice and Demand. Notice and demand is made by the Service when it advises the employer in writing of the amount of tips received by an employee (or employees) who failed to report or underreported tips to the employer. Although no specific form is prescribed, a document will constitute a Section 3121(q) Notice and Demand if it (1) includes the words “notice and demand” and “section 3121(q),” (2) states the amount of tips received by the employee (or employees), and (3) states the period to which the tips relate. However, a document including such information will not constitute a Section 3121(q) Notice and Demand if it states that it is not a notice and demand.

Q10. How does an employer that files Form 941 report the section 3121(q) FICA tax liability after notice and demand is made?

A10. The employer reports the amount of the section 3121(q) FICA tax liability as a current period liability for FICA taxes on the employer’s Form 941 for the calendar quarter in which notice and demand is made. Employers should consult the Instructions for Form 941 to determine the correct line entry on Form 941. The employer must also include the amount of the section 3121(q) FICA tax liability on the appropriate line of the record of federal tax liability (Part 2 of Form 941 for a monthly depositor or Schedule B (Form 941) for a semi-weekly depositor) corresponding to the date of the Section 3121(q) Notice and Demand.

Q11. Which year’s social security and Medicare rates and social security contribution and benefit base apply to compute the employer’s FICA tax liability on unreported tips?

A11. The social security and Medicare rates and the social security contribution and benefit base applicable to the calendar year in which the tips were actually received apply to compute the employer’s FICA tax liability. The Service will compute the employer’s liability, and include a calculation worksheet with the Section 3121(q) Notice and Demand.

Q12. If the Service determines that an employer’s employees have unreported tips and issues a Section 3121(q) Notice and Demand to the employer, what is the period of limitations for the Service to assess the employer share of FICA taxes?

A12. Generally, the period of limitations for assessment under section 6501 of the Code is 3 years after the due date of the return or the date the return was filed, whichever is later. However, section 6501(b)(2) provides that employment tax returns reporting FICA taxes for any period ending with or within a calendar year filed before April 15 of the succeeding calendar year are deemed filed on April 15 of such succeeding calendar year.

As a general rule, the Service must assess the employer FICA taxes on the unreported tips within 3 years after April 15 of the calendar year following the year in which the Section 3121(q) Notice and Demand is made. For example, if the notice and demand is dated December 31, 2012, the liability is required to be reported on Form 941 for the fourth quarter of 2012, due on January 31, 2013. If the employer timely files Form 941, the period of limitations for assessment ends on April 15, 2016.

However, if the employer did not file its Form 941 for the fourth quarter of 2012 before April 15 of the succeeding calendar year (April 15, 2013) and instead filed on May 10, 2013, the Service must assess the employer FICA taxes by May 10, 2016, the date 3 years after the date the return was filed.

If the employer files a false or fraudulent Form 941 for the quarter in which the liability is required to be reported or fails to file Form 941 for that quarter, the Service can assess the additional employer FICA taxes on the unreported tips at any time.

These assessment periods apply whether or not the employer accurately reports the liability on Form 941 as required by Q&A 10 above.

Q13. Is the employer liable for interest on the employer’s FICA tax liability for unreported tips?

A13. Generally, no. If the employer pays the tax on or before the due date of the Form 941 for the quarter during which notice and demand is made, the employer is not liable for interest. If the employer does not pay the tax by the due date of the return, interest will accrue on the underpayment from the due date of the return.

Q14. Is the employer required to deposit FICA taxes due on the unreported tips shown on the Section 3121(q) Notice and Demand?

A14. Yes. The employer must make deposits pursuant to section 6302 of the Code and § 31.6302-1 of the regulations. For purposes of applying the deposit rules, the amount of employer FICA taxes shown on the Section 3121(q) Notice and Demand, is treated as employment taxes accumulated by the employer on the date the Section 3121(q) Notice and Demand is made, which is the date printed on the notice and demand document. The Service generally intends to notify an employer at least 30 calendar days in advance of the issuance of a Section 3121(q) Notice and Demand.

Q15. Is the section 45B credit, with respect to the tips reported on the Section 3121(q) Notice and Demand, available to the employer in the year the notice and demand is made or the year in which the unreported tips were received by the employee?

A15. The section 45B credit is applied to the taxable year that the “excess social security tax” amount is paid or incurred. The section 45B(b)(1) definition of “excess social security tax” is limited to tips that “are deemed to have been paid by the employer to the employee pursuant to section 3121(q).” Under this definition of “excess social security tax,” such tax cannot be paid or incurred prior to the time that the tip amounts are deemed to have been paid under section 3121(q), which occurs on the date on which notice and demand for the employer share of FICA taxes is made to the employer. Therefore, the section 45B credit is available to the employer in the year the Section 3121(q) Notice and Demand is made and not the year in which the unreported tips were received by the employee. The credit is claimed on Form 8846, Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips.

The principal author of this revenue ruling is Linda L. Conway-Hataloski of the Office of Division Counsel/Associate Chief Counsel (Tax Exempt & Government Entities). For further information regarding this revenue ruling, contact Linda L. Conway-Hataloski at 202-622-0047 (not a toll-free call).

What are your thoughts? We would love to hear from you in the comments below.

Cheers!

Have you ever wanted more time and more help in your...

MANGO MAGIC: Marco Estrada, Brownsville, TX 1 ½ oz Aviation Gin ¾...

ALOE WOK: Olya Sabanina, Saint Petersburg, Russia 1 1/3 oz Aviation Gin...

About the author, Elton Marvin Jr. has worked in the food and...

From starting out picking up a Flairco bottle after watching the movie...

From starting out blowing fire behind a bar, performing magic, competing in...

Your cart is empty.

Click “Play” on the video above.

Click “Play” on the video above.

Click “Play” on the video above.